If we suspicion wanton by rail went away, it didn’t

With new oilsands megaprojects commencing operations in a subsequent few months, a volume of oil roving on rail lines could escalate, generally as construction of new pipelines is delayed.

The sentencing of Irving Oil final week to compensate about $4-million in fines for its involvement in a Lac Megantic disaster of 2013 brought a emanate of shipping oil on rail lines behind into a spotlight.

The courtesy paid to relocating wanton by rail appearance after a blast in Quebec, though has subsided since, as volumes of oil ecstatic by railways have fallen.

‘You could see companies looking during knocking a dirt off their rail strategy.’

– Kevin Birn, IHS Energy

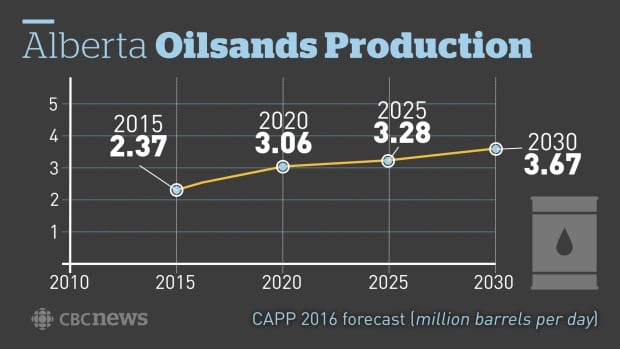

Oilsands prolongation keeps flourishing and will surge once Suncor’s Fort Hills trickery and Canadian Natural’s Horizon plan start estimate bitumen in a entrance months.

“With a supply expansion that is going to be happening, late this year [and] subsequent year — there only simply is not adequate earthy ability to pierce those barrels to marketplace on pipelines that are now available, so it will have to go to marketplace on rails,” pronounced Martin King, a line researcher with GMP FirstEnergy in Calgary.

He’s already seeing aloft volumes being changed by trains.

- What oilpatch gain tell us about life with $50 oil

- ANALYSIS: Will oilsands be producing in 100 years?

“We’re starting to see some-more and some-more indications of barrels removing on a rails generally in Sep by October,” he said. “It’s solemnly trending in that direction.”Â

Â

Crude by rail is some-more costly than transporting wanton oil by tube and considered more dangerous.

Production jump

The Fort McMurray wildfire in 2016 and an blast at Syncrude’s facility this summer are dual reasons because reduction oil was installed into tank cars and exported out of Alberta during the final few years.

Suncor says it expects Fort Hills to be handling during 90 per cent ability within 12 months of startup during a finish of this year. The trickery was built to furnish about 200,000 barrels per day. The association won’t contend how a wanton will be shipped to refineries.Â

The oil industry acknowledges that wanton by rail will turn some-more prevalent in a entrance years.

“Since a tube ability out of Western Canada is radically full and with augmenting prolongation entrance on line, we would design that some-more will have to pierce by rail,” pronounced Chelsie Klassen of a Canadian Association of Petroleum Producers.

Added costs

Large oilsands companies have assembled rail loading terminals in new years or have entrance to those facilities. While a terminals might not have been bustling in new years, that could change.

“We consider that volume of supply will pass a accessible tube capacity, and we will see a resurgence of wanton by rail,” pronounced Kevin Birn, a Calgary-based oilsands researcher with IHS Energy. “In allege of that, we could see companies looking during knocking a dirt off their rail plan and start contrast it out with refiners to make certain they are prepared to pierce this by rail.”

- Oilsands companies watch B.C. solar plan with interest

- New startups confident notwithstanding indolent Alberta economy

Shipping by rail instead of tube is some-more costly and can cost a association about $3 or $4, on average, per barrel, according to Birn, nonetheless that can change as some companies possess their possess loading terminals and rail cars. Some have also have sealed contracts with railways. Increased costs for Canadian producers could outcome in reduction seductiveness from investors.

“It’s a cost companies in a U.S. don’t face, so there are competitiveness issues. It’s an investment disadvantage,” he said.Â

To be sure, new trade pipelines are impending construction, though they face obstacles.

Kinder Morgan’s Trans Mountain Expansion is behind as it waits for permits in British Columbia. TransCanada’s Keystone XL is available approval from state regulators in Nebraska. And Enbridge has run into problems in Minnesota with a Line 3 deputy project.

The National Energy Board examined what would occur if nothing of a vital due tube projects were built (Northern Gateway, Keystone XL, Trans Mountain, and Energy East).

While a regulator’s research enclosed many assumptions, it found that Canada’s wanton by rail volume could stand to destinations such as a U.S. Gulf Coast, Midwest, and East Coast.

Potential problems with increasing rail use embody railway and depot bottlenecks, tanker automobile shortages and foe with other line for travel services in Canada.

Article source: http://www.cbc.ca/news/business/crude-by-rail-fort-hills-firstenergy-ihs-1.4375789?cmp=rss