How financier certainty in Canada softened in only one conspicuous week

What a disproportion a week can make.

Canada has been in a rut with enticing companies and investors to see a nation as a good place to do business. Investment began to tumble 4 years ago and melancholy grew further when Donald Trump began putting adult trade walls around a United States. Declining investment has put a aria on a Toronto Stock Exchange and a loonie.

Critics have been vocal, though a final 7 days could good infer significant in starting to shift the perspective of Canada, from inside and outward a country’s borders. There are finally some reasons for optimism.

First came the USMCA — the new NAFTA — a trade understanding with a U.S. and Mexico. The cloud of doubt unresolved over Canada as negotiations dragged on vanished.

A fibre of deals

Then came a fibre of deals in a ardour sector, many important of that was a Royal Dutch Shell-led consortium LNG Canada relocating forward with a $40-billion healthy gas trade trickery on B.C’s coast. For a nation carnivorous of big-ticket corporate spending, take note — this is a singular largest private investment in Canada’s industry.

It might be only a coincidence, though it’s also notable a understanding is in a oilpatch, that has given a sovereign supervision a harshest tongue lashing for scaring divided investment.

Two other ardour companies also finished headlines with Husky announcing a antagonistic takeover attempt of oilsands producer MEG Energy for $6.4 billion, and to a finish week, Precision Drilling charity to buy up another Calgary-based oil and gas use company, Trinidad Drilling for about $1 billion.

All of this in only one week.

“This is a ideal charge in foster of Canada. We’ve had a series of factors assisting to lift spirits in Canada and about Canada in a general investment community,” said Karl Schamotta, a banking strategist during Cambridge Global Payments. “To some extent, Canadian companies have been kick adult and undervalued on general exchanges and so it’s spurring investors to demeanour where value can be found.”

- Alberta business personality scolds PMÂ for pushing off investment

- Feature:Â The good oilsands epoch is over

Loonie upswing

On tellurian banking tables, Schamotta says a loonie is now outperforming other currencies, notwithstanding low oil prices in Alberta, that traditionally would lift down a value of a dollar.

The activity this week in a oilpatch, in particular, will roughly positively have held a courtesy of investors. Companies like Husky are still captivated to flourishing their oilsands portfolios, while a LNG Canada plan is a initial time in 5 years a association has announced construction of a greenfield mega-project of this kind around a world.

The announcements float opposite a waves of comments by critics who have called Canada a bad place to invest.Â

“It’s an unusually certain development. The opinion of certainty Shell is putting behind a economy and Husky as good — that’s going to support financier appetite,” said Schamotta.

Is this only a blip?

The doubt now is either this signals a change in momentum, or is it merely a blip of cheer. Sceptics say issues like a country’s high domicile debt levels persist, while others contend a mercantile boost from a USMCA pact will be limited.

“The trade understanding is doubtful to do really most to lift Canadian enlargement prospects. However, though a deal, Canada’s economy would grow noticeably slower,” wrote James Marple, comparison economist with TD Bank, in a investigate note on Friday.

Other superb concerns about a regulatory routine for constructing major projects are also unsettled.

Investing in a ‘patch

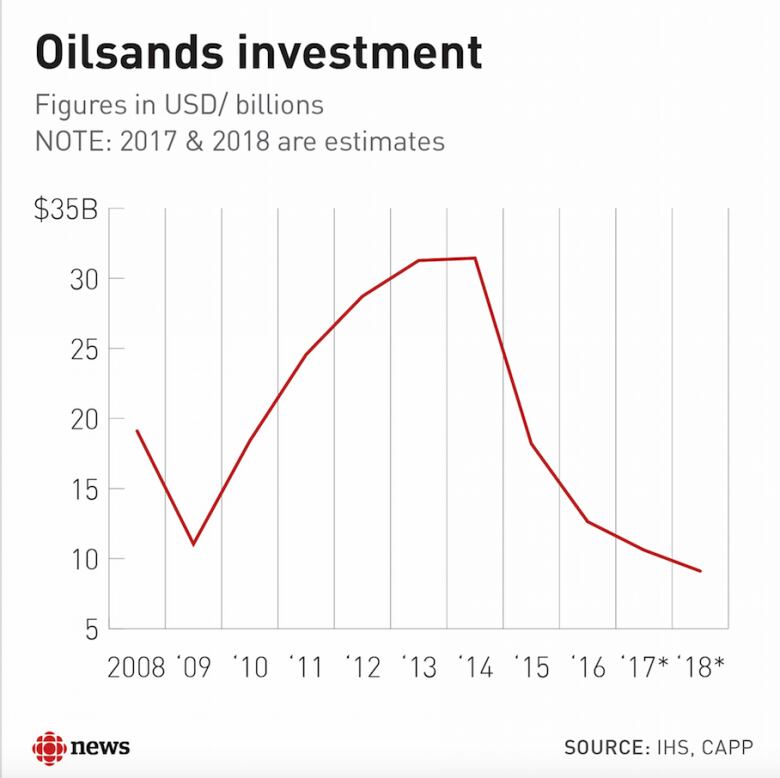

Oilpatch investment has driven a Canadian economy for most of a final few decades, until a cost pile-up in late-2014. Since then, companies have invariably pulled behind on spending. The sepulchral enlargement in a oilsands is over.

Oil prices have recovered around a world, though sojourn incredibly low in Alberta given of pipeline constraints and other issues.

The country’s mercantile prospects soured serve when Trump became a U.S. boss with threats to rip adult NAFTA and digest entrance to a American market. Consider Trump’s taxation changes and regulatory overhaul and no consternation general investors were lukewarm about putting their income in Canada.

See Chrystia Freeland discuss a highway to USMCA:

Earlier this year, Statistics Canada expelled information display approach investment into a nation was $33.8 billion, a lowest turn given 2010 and good brief of a record high of $126.1 billion behind in 2007.

The angry in a oilpatch has grown louder in new months generally after continued delays to construction of a Trans Mountain enlargement oil trade pipeline, that was nearing construction before a sovereign justice effectively tore up a pipeline’s assent during a finish of August. The sovereign government, that now owns a project, is still vowing to build a pipeline.

Husky Energy Inc. is creation a antagonistic bid to acquire MEG Energy Corp. in a transaction valued during $6.4 billion. (David Bell/CBC)

The LNGÂ industry has had a satisfactory share of failures over a years as some-more than a dozen comforts were due in B.C. But one after another they were delayed or cancelled. The trend stopped with LNGÂ Canada strictly commendatory a healthy gas trade facility.

“It paints a perspective that Canada can still get some things finished notwithstanding some of a issues on a oil pipelines. People are peaceful to deposit here,” pronounced Martin King, a line researcher with Calgary-based GMPÂ FirstEnergy.

Now that one LNGÂ facility will shortly be underneath construction, King says that creates it easier for others to follow.

“Maybe this is a thing that opens a doorway and gets some-more people entrance in and looking during Canada,” he said.

Will a certainty endure?

This past week will yield an initial boost of optimism, though some consternation either it will hang around.

For one, investors will wish to see how Bill C-69 unfolds in Ottawa. It is a due legislation that’s set to renovate a regulatory complement that reviews vital construction projects before approval.

The supervision says a check is designed to digest a regulatory routine and embody conference with some-more stakeholders, though critics contend it could supplement more uncertainty for companies looking to make sizeable investments. It’s casting a “long shadow” on a oil and gas sector, in particular, according to King, though many other industries too.

“This is not only pipelines — this is mining projects, hydro lines, all kinds of stuff,” he said. “In a view, it’s mostly designed to forestall infrastructure from indeed being constructed.”Â

For now, a mood among investors appears to be up. In 7 days, the NAFTA renegotiation stand-off was resolved and a few blockbuster announcements were finished in a ardour sector. Individually they are noteworthy, though in totality, they could vigilance a start of a change divided from a ‘sell Canada’ narrative.

Article source: https://www.cbc.ca/news/business/investor-confidence-lng-canada-usmca-1.4851969?cmp=rss